How does black box insurance work? Telematics car insurance explained

Unfamiliar with black box insurance? This guide aims to answer our most common questions about telematics insurance

What is telematics insurance?

Simply put, telematics insurance is a policy that monitors your driving to make sure that you are driving to a safe and acceptable level. In return, the insurer will offer you a lower premium, as they will be able to see you are more responsible and less likely to make a claim.

But what does black box insurance measure? Well, it varies from insurer to insurer, but here at Marmalade, we monitor 5 areas of your driving. These are speeding, accelerating, braking, cornering speed and phone usage. All of these areas of your driving are available for you to see on the mobile app. This allows our drivers to monitor their own driving and take responsibility for how they can improve.

How is telematics car insurance different to normal insurance?

In essence, with black box or telematics insurance, there is very little difference from a normal policy. It is fully comprehensive, available for provisional and full licence holders and if you drive for 12 months without any fault claims, you will get a full year's no claims bonus.

The only difference with black box insurance is that the insurer will be able to monitor your driving to make sure that you are a responsible driver. This means that telematics car insurance quotes are often cheaper for young drivers and renewal premiums will reflect how you’ve driven over the year. Plus you can see your driving score, just the same as we can, and you can use this to improve your driving style (if you need to!).

Compare black box car insurance options

Annual insurance on your own car

For the main driver

Instant comprehensive cover

Cover before and after you pass your test

No price increase when you pass

Drive well and earn an extra safe-driving discount at renewal

Annual insurance on a parent’s car

Cover for up to 10,000 miles per year¹

Alternative to being a named driver

No risk to parents’ no claims discount

For full and provisional licence holders

No increase in price on passing your test

Pay as You Go insurance

Handy for sharing a parent’s car!

Only pay for the miles you drive

Exclusively for full licence holders only

No risk to your parents’ No Claims Discount

Earn your own No Claims Discount

Which telematics insurance technology is best?

If you don’t know which black box insurance is the best, first you need to know that there are 3 types:

- Plugin or wired device

- App on smartphone

- App and telematics tag

All our new policies use an App and telematics tag. This works best as it is accurately able to monitor your driving and give you feedback directly through the mobile app. The tag doesn’t need to go onto the battery and can be fitted to any car.

If you’re wondering “how do insurance companies fit a black box?”, the answer is that we don't. You do! This means no waiting for an engineer to come to you, or having to book in at a garage. You are covered immediately from when your policy starts and all you need to do is stick the small telematics tag to the inside of the windscreen once it’s arrived in the post. Read our guide to fitting a black box to see just how easy it is.

How does black box insurance work?

Black box insurance works by using a small GPS device to monitor your accelerating, braking, speeding, cornering speed and by connecting it to your phone, it also measures your phone usage. All of this is available on the mobile app to help you monitor your driving

All of this information is then used to generate your driving score, which is available to you via the mobile app. Your driving score will show you how well you have been driving and our safest drivers can earn themselves a safe driving discount at renewal.

The majority of customer journeys (96%) are green journeys - and green means your driving is good. Sometimes though, where there are a number of unsafe driving events flagged, this can cause a red journey. It’s rare though, as less than 2% of all journeys are flagged as red. If you do get a red journey, we’ll get in touch, but you’ll also be able to view the journey on your app to see what areas were flagged and exactly where on your route the incidents happened. This helps you understand where there’s room for improvement.

Who should choose black box insurance?

How much does black box insurance cost?²

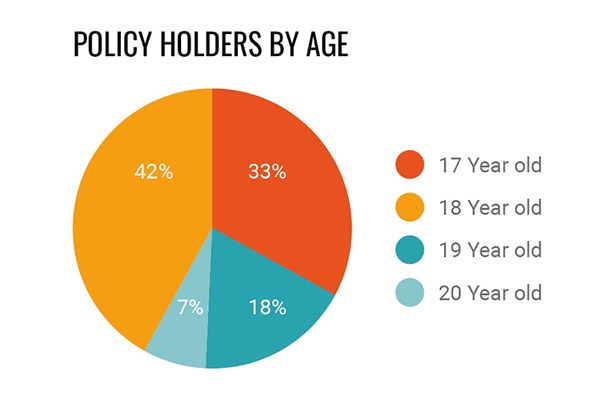

The average cost of insurance for a young driver in the UK is £1954³, so having a black box insurance can make it more affordable. These are the average premiums paid, by age, by our customers². As well as paying less in their first year, our customers save on average 23% on their first year's renewal premiums*.

- 17 years old - £1,246

- 18 years old - £1,342

- 19 years old - £1,217

- 20 years old - £1,052

- 21 years old - £976

Get on the road today...

Frequently asked questions

The black box needs to be stuck to the inside of your windscreen, just behind the rear-view mirror. This is where it collects data most accurately and as it’s nice and small, you don’t need to worry about it obstructing your view.

If you get a new car or have a windscreen replacement and need to remove the box, you can simply peel it off and stick it to the new car!

If you need some more guidance, you can read our page on how to fit a black box.

If you've purchased a policy with Marmalade you'll have provided us with certain information including details about yourself, the car you're driving, your driving history and any named drivers you have added. This information enables us to provide you with a price and set up the policy in your same.

Once the policy is set up, to monitor your driving, we will measure 5 key areas of your driving:

- Accelerating

- Breaking

- Cornering Speed

- Speeding

- Phone Usage

As you would expect, here at Marmalade, we store any information we hold securely. If you’d like to find out more about the data we hold, please read our privacy policy.

The black box provides feedback on the five areas of driving we monitor. These are acceleration, braking, cornering speed, speeding and phone usage. Our smart app places driving events on a map to show you where issues are happening to help you pinpoint where you can improve.

With good driving, you can earn streaks and badges on the app to show off your driving ability!

Parent advice

Advice and guides for parents helping their learner driver on their driving journey.

Black Box Mythbusters

There’s a lot of misconceptions around driving with a black box – we’ve got the facts on what’s true and false!

Visit the Driver Hub

Check out the latest stories and blogs from young drivers