Black Box Insurance FAQs

Here are some of the queries we're most commonly asked. If there is something you would like to know, then take a look through and see if we've answered it here.

Got a question? Take a look and see if we’ve answered it here

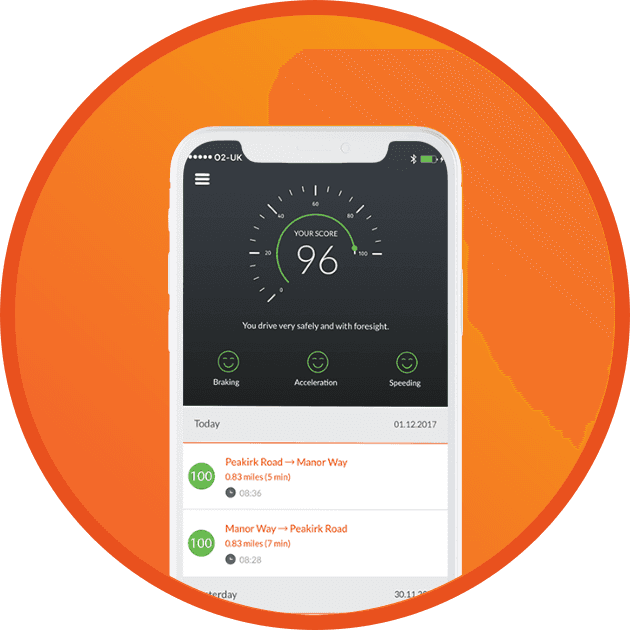

Also known as black box insurance, telematics utilises a discreet black box (in this case a small tag) which lets us know how you're driving by sending information to us via a GPS signal. The box measures distance, location, acceleration, braking, cornering, average speed, and phone usage and helps us to tailor your renewal premium to your driving style. Read more about telematics here.

How do I fit the telematics tag?

There are step by step instructions in the box that the tag is sent in. It’s quick and easy to fit, as the device has self-adhesive strips on the back to enable you to secure the tag to the inside of your windscreen directly behind the rear-view mirror.

What does the telematics device measure?

It will measure and then transmit details about how you are driving the car during each of your journeys. It will measure things like speed and acceleration force, braking force and frequency, swerving, sudden manoeuvres, cornering, mobile phone use, distance travelled, the types of routes driven, the time and date of journeys, and your car's location. All of this information will then be used to give you your driving score. Take a look at our Monitoring your driving page to find out more.

Am I insured before the box is installed?

If you have selected our annual option, you can start driving as soon as your policy starts. However, you need to fit the telematics tag as soon as it arrives and pair it with the Marmalade Insurance App.

Drivers who have opted for our Pay As You Go insurance option will only be covered once they have paired the Marmalade Insurance smartphone app with the tag, and fitted it to their car windscreen. You will receive confirmation that the policy has started when you’ve paired the app with the telematics tag.

Does a Black Box Insurance policy cover business use?

We can provide cover for business use. If you require this cover, you can select this option when you get a quote.

Is there a night time curfew?

No. Unlike some telematics offerings which offer black box insurance, you are covered to drive any time you like, day or night.

How do you know who is driving the car?

After a while, the tag and app will begin to recognise different driving styles, and will assign trips to the policyholder or named drivers accordingly. However, if a trip is wrongly assigned, the policyholder can re-assign the trip in the app. Please be aware that dishonestly re-assigning your trips could result in cancellation of your insurance.

What happens if I disagree with my journey rating?

You have the right to appeal a journey rating within 24 hours of receiving the notification. Please call us on 0330 343 8814 to have the journey reviewed manually by a member of the team.

Will I be penalised if I drive badly?

Journeys are rated using a traffic light system of green, amber and red. The majority of customers drive in the green, which is “good". However, Red journeys are classed as unsafe. Drivers that incur repeated red journeys will follow our Red Journey Process which may lead to a premium increase. Full details can be found in our guide to the red journey process.

Can I connect my phone to my car to play music?

Yes, you can. You will need to connect the phone to the car’s on-board computer and change the songs/volume via the car and not on the phone. The phone cannot be touched or in motion whilst driving.

Can I use a sat nav app on my phone while driving?

Provided that you set the navigation to commence before you turn the ignition on and start your journey, then yes you can. However, once you are driving, you should not touch your phone until you are have stopped and turned the engine off, or it will flag as distracted driving.

What do I do if I, the policyholder, am a passenger in the vehicle?

If you’re a passenger in the insured car, and not driving, you can turn the Bluetooth off for the journey. If you need to keep your Bluetooth on, it’s best to let the person driving get in their car so that their phone pairs with the tag first, before you get in. If the trip is wrongly assigned to you, you can re-assign the trip in the app.

Can a passenger use my phone during the journey?

Our technology is pretty good; however, it can’t distinguish between the driver or the passenger holding the phone. This means that your phone should not be used by anyone in the car on your journey or it may flag distracted driving.

I already have a telematics device in my car from my previous insurer. Can I use this one instead?

No, for this policy you need to use the telematics tag we provide. Simply fix it to your windscreen behind the rear-view mirror in your vehicle.

Yes, you are insured to take your driving test in your car with our black box insurance, and cover will continue seamlessly after you pass. Before you commit to taking it in your own car, please check the DVSA requirements to ensure you’ll be eligible on the day. This includes making sure the car is taxed and MOT’d, has L-plates fitted, and an extra interior mirror. Make sure you bring a copy of your insurance documents with you. Read more about the requirements on our advice on taking the driving test in your own car page. Once you’ve passed, don’t forget to contact us and let us know, and to email us a copy of the front and back of your full licence when you receive it.

I’ve had a previous Marmalade policy on a car I borrowed, how do I claim my 10% discount on Black Box Insurance?

If you’re using the same email address and your details have not changed since your previous policy, your discount should appear on your Black Box Insurance quotation. If you are expecting to see a discount and it does not appear, please give our team a call on 0330 343 8814 and we’ll look into it for you. If you are eligible, we can arrange the policy for you over the phone with the discount applied.

How do I receive my policy documents?

We'll email you a link to log in to access your documents online with the login details you receive. If you prefer, you can request paper copies of these documents at any time during the policy term, by emailing [email protected]. No charge will be made for this.

As the policy provides comprehensive cover, am I insured to drive other vehicles?

No. Because we use the telematics device to monitor your driving, we'll only cover you for the car it's fitted in.

Can I have more than one named driver?

Yes you can. You're allowed a maximum of two named drivers on your policy.

Can I get insurance on a car that's owned by someone else?

Yes, provided the owner of the car is your parent, your spouse/civil partner, or a vehicle leasing company.

I would like to insure the car in my parent's name with me as a named driver, can I do this?

Afraid not. The policy needs the main driver to be aged between 17 and 30. So, if you're added to the policy as a named driver but you're actually driving the car the majority of the time, then this is what's called 'insurance fronting' which is a form of fraud.

Can I get cover in Northern Ireland?

Yes indeed, you’ll be pleased to know we are able to provide young driver insurance in the majority of NI postcodes.

Will my insurance cover me to drive in Europe?

Your policy gives you 90 days’ comprehensive cover when driving abroad in EU countries*. After 90 days, you will only have the minimum level of insurance cover required to drive in those countries.

Can I add breakdown cover to my Black Box Insurance?

Yes, you can add breakdown cover from Call Assist from just £25. We’ll show the cover options available to you alongside the quote for your black box insurance. You can choose from Local, National or European cover – giving you peace of mind throughout the year that, if you break down, you’re covered. Before you buy, don’t forget to check that you don’t already have this cover elsewhere (e.g. in a packaged bank account or as part of a new car warranty).

Does my insurance come with a courtesy car?

If you have an accident and your car is being repaired using one of our approved repairers, you will be entitled to a replacement car whilst the repairs are undertaken. However, a courtesy car is not provided if your car is stolen or a total loss. Hire Car cover can be added to your policy should you wish to have a replacement car (for up to 14 days) in the event of an accident resulting in your car being undriveable, or if your car is stolen. It’s worth noting that this cover is only available to full licence holders aged 21 or over, or those over 18 who have held a full licence for a minimum of 6 months.

How do I change my insured car?

If you would like to change the car on your policy, or change your details, please call us on 0330 343 8814 and we’ll be happy to arrange this. There may be fees payable to make a change, please read our policy details page for more information. It’s important to let us know of any changes to ensure your insurance remains valid.

Do you provide legal cover?

Motor Legal Expenses cover can be added to the policy fee for a small premium of just £10 a year. This will provide up to £100,000 worth of legal representation to help recover uninsured losses where you or a named driver are not at fault. Such losses could include excess payments you have made, loss of earning as a result of the accident, medical care, and compensation for injuries you suffer.

Who underwrites my Marmalade Black Box Insurance policy?

We work with a panel of underwriters to help us offer you the best price we can. You’ll be advised of the underwriter for your policy on your quotation or your renewal invite. You can also find out more about the insurer who underwrites your policy by logging into your account and viewing the “Additional Insurer Information document”.

It's when you get a reduction in your premium as a reward for having a claim-free record.

How do I obtain proof of my No Claims Discount?

If your policy has not yet expired, you can download your Renewal Schedule by logging into your account. This confirms the number of years No Claims Discount you have earned. If your policy has expired, you will find a copy of this document attached to an email we sent you confirming cover had ended. If you are unable to locate the document, please email [email protected] and we will send you a copy.

How do I send copies of my driving licence or proof of No Claim Bonus?

The quickest and most reliable way to send these is to scan them, or take a picture of the document(s) with your phone, and send them by email to [email protected]. Alternatively, you can send copies the old-fashioned way, by post, to Marmalade House, Mallard Road, Bretton, Peterborough, PE3 8AF. If you’re sending us a copy of your driving licence, don’t forget to take a picture of the front and back of the licence!

Yes you can. Marmalade offers you the choice of annual or monthly car insurance payments. You can either pay the premium in full when taking out or renewing your policy, or you can spread the cost of your insurance by paying in monthly instalments. Additional fees & terms and conditions apply. Marmalade acts as a credit broker, not a lender. Give us a call on 0330 343 8814 and talk to our friendly customer service team if you need further information.

Let us know at your first opportunity on 0330 343 8814 and we will investigate the issue further for you.

Why can't I see my journeys?

Please check that Bluetooth and location services are enabled and that there is no metal or significant barrier between the smartphone and tag (e.g. the glove compartment). If you are having issues, we advise you to find the Marmalade Insurance App in your phone settings, turn off the permissions for a few seconds (e.g. location service), and then turn them back on. This should resolve the issue for future journeys.

How do I know the tag is working?

Once it’s activated, the tag will just sit quietly on your windscreen with no lights. Provided your trips are recorded, it is all in working order. From time to time, the light may flash when it is transmitting data to your smartphone or is receiving a firmware upgrade. However, if you notice a red light, there may be an issue so we’d ask you to get in touch with us.

If you would like to cancel your policy, please give the team a call on 0330 343 8814. You can find details of our cancellation charges on our policy details page. If there has been a loss claim, there will be no refund and the full annual premium is payable.

Parent advice

Advice and guides for parents helping their learner driver on their driving journey.

Black Box Mythbusters

There’s a lot of misconceptions around driving with a black box – we’ve got the facts on what’s true and false!

Visit the Driver Hub

Check out the latest stories and blogs from young drivers